It’s been 3 years since the law on Stamp Duty Land Tax (SDLT) changed. If you are purchasing a residential property in addition to your main home, there’s now an extra 3% tax to pay over and above the normal rate.

The tax surcharge applies to all properties over £40K including holiday homes and BTL investment properties both in the UK and abroad, and even if you are not the sole owner. Caravans, mobile homes and houseboats are exempt. Confusingly, your main residence may also be affected. More of that below but let’s start with the basics.

How Stamp Duty Land Tax is calculated

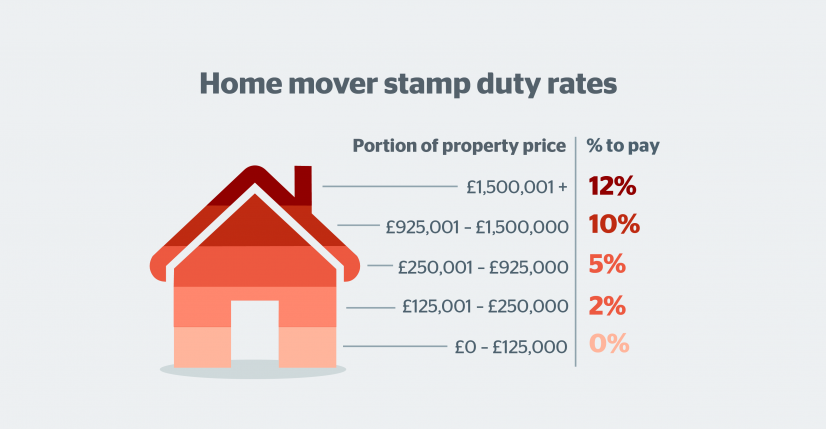

You may not be aware that the rules regarding standard Stamp Duty Land Tax were overhauled back in 2014. Before that time, the tax was levied on the purchase price of the property as a slab tax but since then a tiered system has been put into place. A bit like income tax, it means that you pay a higher rate on the slice above any threshold.

Source: Which?

The new system can lessen your tax liability when you buy a property. Assuming a £300K purchase price, the whole amount would have been taxed at 3% under the old regime, resulting in a £9K tax bill. Under the new system, there’s nothing to pay below £125K, then 2% is payable on the next £125K (= £2.5K) and 5% on the remaining £50K (= £2.5K), producing a lower total tax bill of £5K.

So far, so good, but what happens when you factor in the most recent changes?

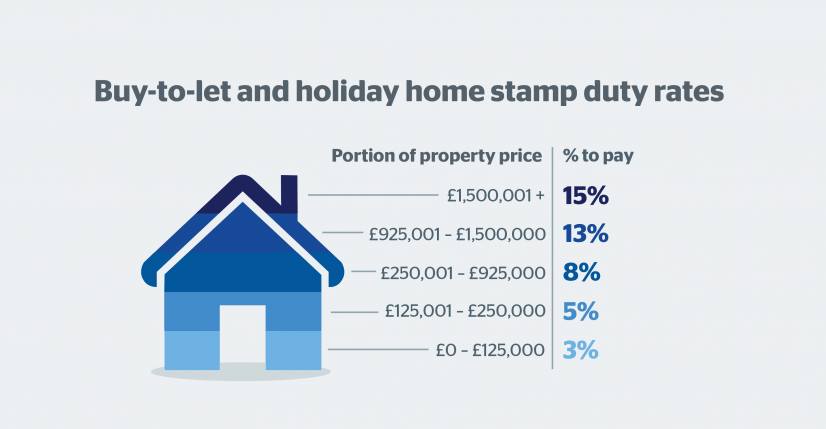

SDLT surcharge for second homes

The new Stamp Duty Land Tax (SDLT) surcharge was introduced in 2016. Unfortunately for investment property and second home buyers, this is a flat rate 3% tax levied on the entire purchase price. If, say, the above example was a second home purchase, you would be charged 8% on a £300K property, resulting in a £24K tax bill.

Source: Which

The government has provided a handy Stamp Duty Land Tax Calculator to help you work out the SDLT payable on your property transaction.

Could your main home be liable for the surcharge?

This is where it gets interesting, not to mention a little bit worrying. Your ‘main residence’ has to be verifiable as not just a property you own but the one you live in permanently. Unlike other taxes such as Capital Gains Tax where you are able to ‘elect’ your main residence for tax purposes, you must be able to provide HMRC with proof of your main home through official records such as the electoral register, local GP, schools etc.

Regardless of how long you have lived in your main residence, when it comes to selling you may find yourself in one of three scenarios:

Selling and buying at the same time

If you are selling your main home at the same time as buying a new one, you will not be liable to pay the SDLT surcharge. This is the case even if you also own other property assets, since these are not affected by the transaction.

However, in the case where a person lives in rented accommodation or with relatives but has an investment property, and then decides to buy his own home, the surcharge will apply. What’s more, if you buy a home together with another person, and the above applies to only one of you, the tax will still be payable.

Buying a new home before selling the old one

If you haven’t sold your existing home but are purchasing a new ‘main residence’, you will be charged the full 3% SDLT surcharge at the point of purchase. You then have a period of 36 months within which to sell your previous home and claim the tax back in full.

Once the old property has been sold, you need to submit your refund application to HMRC within 12 months.

Selling your main residence before buying a new one

Clearly, if you are selling your old home first, there is no extra stamp duty to pay on buying a new home unless you own other residential property. There is now a 36 month grace period that allows you to purchase your new home without being liable for the surcharge as long as your previous main residence was sold within 36 months.

If you are returning to the UK after a period of living abroad, or own property in another country, this should help you to purchase a ‘stop gap’ home without being charged the extra tax.

POSTED BY

POSTED BY